In Geopolitics This Week

Recent Russian Military Manoeuvres in Ukraine, Russia-Ukraine War and Agricultural Commodity Markets, Germany Announces Massive Boost to Military Spending, and other stories.

Recent Russian Military Manoeuvres in Ukraine

While the positions and movements of Ukrainian forces are typically not publicized in the public domain, publics are treated to an exceptionally coherent intelligence picture of Russian military manoeuvres in Ukraine. This shouldn’t be surprising, narrative is a key front in any war, and information is potent ammunition which can be directed at both allies and enemies. Given these constraints on access to information, a look at the well-documented positions and manoeuvres of the Russian forces is one — though limited — way to understand the reality on the ground amidst the fog of war.

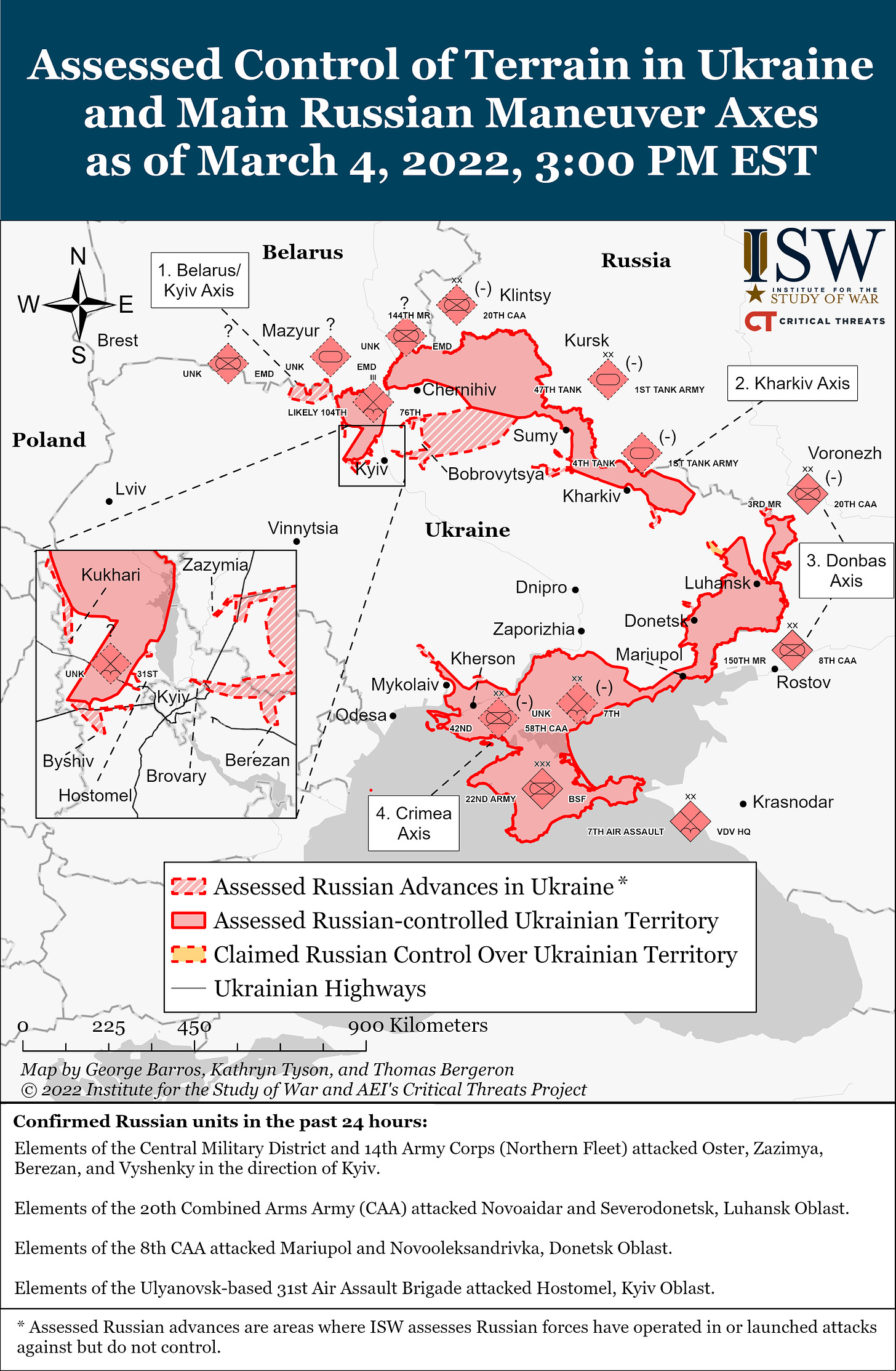

Open source intelligence of recent Russian military manoeuvres in Ukraine signal a rapidly-developing situation across the whole country. In the North, Russian forces continue their efforts to gradually achieve a total encirclement of Kiev. Ukrainian forces have managed to stall a western envelopment, but Russian troops have now rapidly positioned themselves East of Kiev, with more arriving in the capital’s outskirts every day. Russian forces have advanced on the eastern outskirts of Kyiv and may attempt to encircle and/or attack the capital in the coming days. However, he speed of the advance will likely slow as Russian forces leave flat terrain and enter congested suburbs.

In the Northeast, a Russian ground offensive against Kharkov has stalled with some forces reportedly diverted to the west and southeast, weakening Russia’s ability to encircle or seize the city in the coming days. The manoeuvre southeast toward Novoaidar and Sievierodonetsk is likely seeking to link up with the Donetsk and Luhansk proxy forces. With this diversion of forces, Russian now appears to be de-emphasizing the seizure of Kharkov as an immediate goal in favour of supporting other units elsewhere.

In the South, Russian forces have secured Kherson city and renewed an advance on Nikolaev as a likely precursor for a future attack toward Odessa. A ground assault on Odessa is expected to be launched in tandem with an amphibious attack conducted by Russian naval infantry. Russian gains in the region have already led to the scuttling of the flagship of the Ukrainian Navy Hetman Sahaidachny, a move done in order to avoid the ship falling into the hands of Russian forces. At the same time, a Russian advance along the Dnieper River has led to fighting near the Zaporizhzhia Nuclear Power Plant as Russian forces have seized the city of Enerhodar. Russian forces here are looking to seize the power plant and a nearby thermal power station in order to control the supply of electricity to eastern Ukraine. Elsewhere in the South, the Russian military has concentrated considerable forces around Mariupol, and are close to completing an encirclement of the city.

As fighting rages on across multiple axes of attack in Ukraine, Russian and Ukrainian negotiators have held a second round of talks. The meeting appears to have been a positive first step as both sides agreed to establish a “humanitarian corridor” and implement an immediate cease-fire surrounding it. The evacuation corridor involves the city of Mariupol and will work to allow civilians to evacuate before an anticipated Russian offensive in the city begins. In a previous round of talks between the two warring sides, the Ukrainian delegation said that they were seeking an immediate ceasefire across the entire country, a temporary armistice, and the establishment of humanitarian evacuation corridors for civilians. The agreement reached is a concrete step in achieving some of these Ukrainian objectives, but it nonetheless does not in any way stipulate a cessation of hostilities elsewhere in Ukraine.

Russia-Ukraine War and Agricultural Commodity Markets

Russia and Ukraine are major agricultural commodity suppliers, and both have become an important source of food across for many countries across the globe for the past 25 years. The war currently playing out in Ukraine, coupled with the sanctions being levelled at Russia, could seriously impact their food and agriculture exports, and thereby threaten global food supplies as both play a crucial role in the production and export of grains (corn, wheat, and barley) and oilseeds (particularly sunflower and sunflower oil).

Russia and Ukraine account for 14% of global wheat production, and rank 1st and 5th for global share of wheat exports respectively (2020 data). In terms of corn production, Ukraine now ranks 4th and contributes over 15% of world corn exports, while Russia ranks 6th with a 2.3% share. For barley, France holds a dominant production share and is a leader in world barley exports, but Russia and Ukraine nonetheless hold a significant role in this market, both together accounting for about 19% of barley production and almost 32% of barley exports. Ukraine and Russia are also both leading producers and exporters of sunflower oil. Nearly 60% of the world’s entire sunflower oil production occurs in Ukraine and Russia, and the two countries account for more than 75% of world exports. Fertilizer-related products could also see turbulence in pricing over the coming weeks as Russia and Belarus are both major players in this sector.

Russia’s and Ukraine’s role as major exporters of food and agricultural products means that disruptions in these supply chains could lead to significant unrest in places that are dependent on these supplies, such as the Middle East and North Africa. A combination of higher energy prices and disrupted food supplies have the potential to threaten the stability of Saudi Arabia, the UAE, Libya, Iraq, Egypt, Israel, and even Turkey. While several countries in the Middle East and North Africa attempt to stay neutral over Russia’s use of military power in Ukraine, the economic realities associated with the imposition of sanctions will for many be difficult to avoid.

A protracted conflict in Ukraine has the potential to threaten the stability of many countries both directly and indirectly. For Israel and Turkey, the situation is particularly complicated. Russia’s overt use of military power against Ukraine has put Israel under significant pressure as its leadership is concerned about a potential asymmetrical retaliation by Moscow in Syria and Iran if it were to overtly support Ukraine. As for Turkey, its main energy supplies are directly connected to Russia, as are numerous other economic relationships which underpin the very fragile Turkish economy.

A continuous supply of food may be the most significant threat facing the Middle East and North Africa as a result of the war in Ukraine. The need for a consistent supply of food is necessary to maintain stability in any country, a reality especially concerning for many import-dependent countries in these two regions. Particularly hard hit here could be Egypt, to which the potential loss of wheat, corn, and sunflower oil commodities could threaten social cohesion if alternative supply chains are not quickly established.

Germany Announces Massive Boost to Military Spending

One long-term repercussion to emerge from the recent Russian use of military power against Ukraine has been the sudden willingness of German officials to drastically increase military spending. Following Russia’s widespread use of military power in Ukraine, — as well as weeks of immense pressure applied on German officials by EU and NATO member states to do more to assist the armed forces of Ukraine — Germany appears set to once again militarize as Chancellor Olaf Scholz announced a drastic policy shift to increase German military spending moving forward.

The move to drastically increase defence spending will see considerable investments made toward bolstering Germany’s armed forces and diversifying away from Russian energy supplies. For Germany, international relations after World War II, and especially after the Cold War, have been underpinned by economics and economic relationships. But that may no longer be the case going forward. Russia — while significantly less powerful than the Soviet Union was during the Cold War — is still powerful, and looks to be determined to reclaim its own sphere of influence.

The United States, while still the dominant military power in Europe, is increasingly looking toward the Indian and Pacific Oceans, and may in the decades come to be less involved (directly, at least) in the security of Europe. This poses a problem for Germany, which may in the future no longer have the privilege of focusing on economic matters while being assured that Washington will continue to provide security for the entire European Union via NATO. And so the war in Ukraine is a stark reminder to German policymakers that its important economic relationships may need military enforcement mechanisms, and that this enforcement must not depend on the will of the US. As such, the German question has once again emerged, and Germany looks set to dramatically increase military spending over the next 5 years.

Scholz’s announcement therefore marks a geopolitical turning point as Germany embarks on the most significant military build-up since the fall of the Third Reich. Berlin has committed to increase its military spending to be more than 2 percent of GDP annually, beginning with an immediate investment of €100 billion euros. The announcement also included plans which would see Germany fast-track the construction of two liquefied natural gas (LNG) terminals, a move that will mean a greater German reliance on LNG imports from the United States rather than natural gas imports via pipeline from Russia. The repercussions of this decision could be profound as German rearmament on such a scale could manifest into an imbalance in the current European military footprint within NATO. Most critical in this regard is the fact that such a move would, in time, mean that Germany would supplant France as Europe’s top military power.